Workplace wellbeing solutions to support your employee’s mental health

PAM Wellness Solutions supports organisations across the public, private and charity sectors working with a range of clients of all sizes throughout the UK and overseas. We effectively support workplace wellbeing to proactively reduce absence, minimise work-related stress and boost resilience to help improve productivity and mental health in the workplace.

Our suite of mental health, psychological, EAP and wellbeing solutions, alongside our neurodiveristy and corporate health screening services, enable organisations to engage with us as their expert partner to support their health and wellbeing needs, and for their employees to benefit from the multidisciplinary expertise of our extensive team.

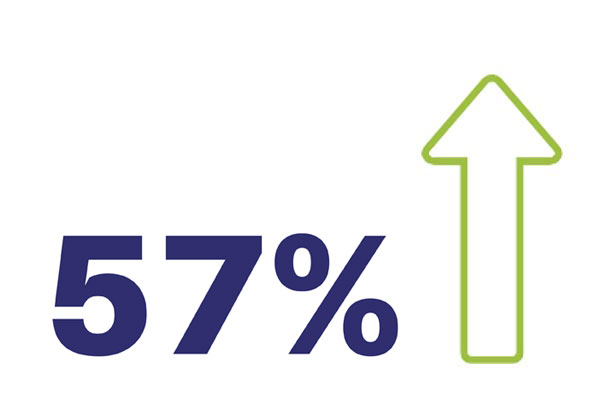

Wellbeing solutions that deliver success

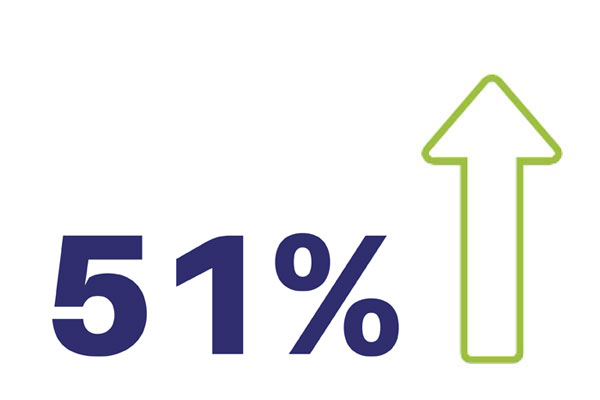

Improvement in Generalised Anxiety Disorder (GAD-7)

Source: PAM Wellness Solutions

Improvement in Patient Health Questionnaire (PHQ-9)

Source: PAM Wellness Solutions

Return on investment with EAP services

Source: EAPA ROI Report 2023

How can PAM Wellness Solutions help?

We are the leading workplace wellbeing, mental health and neurodiversity support service for your organisation and your employees. We have many years of experience and a proven track record in delivering EAP services, workplace wellbeing, neurodiversity solutions and corporate health screening; supporting organisations with proactive solutions for their employee’s physical and mental health.

Our services support your employees with practical and emotional tools, as well as assistive technology to be able to better manage all areas of their lives, providing both pro-active and reactive workplace mental health, neurodiversity and wellbeing solutions that are designed to create long-lasting results.

Our team of skilled clinicians obtain continuous development opportunities enabling progressive delivery of a comprehensive range of high-quality services throughout the UK in which we support over two million individuals. Our services are delivered via a bespoke combination of on-site staff, remote services, and face-to-face services, utilising a UK-wide network of PAM clinics.

Working with PAM Wellness Solutions

Introducing a wellness strategy can deliver tangible benefits and return on investment. We will work with you to develop a bespoke plan for your organisation.

The benefits we will bring to your organisation:

- Proven and evidenced reduction in levels of anxiety and depression

- Providing a duty of care to your workforce

- Reduction in absenteeism

- Limiting staff turnover and attracting new staff

- Increase in health and wellbeing of your workforce

- Creating a culture of wellbeing and awareness, where employees feel supported

- Addressing issues proactively to avoid crisis or burnout

- Delivering an additional, valued benefit for employees and managers alike

- Improving performance and productivity

What clients say about PAM Wellness Solutions

Latest News

Mental health blog

Moving More for our Mental Health Ahead of Mental Health Awareness Week

This year’s Mental Health Awareness Week will take place from 13 to 19 May 2024, on the theme of “Movement: Moving more for our mental health”. The benefits of moving our bodies to improve our mental health are well documented. As employers, it is crucial to encourage employees to move during the working day to […]

Webinar - 16th May 2024 | 9.30am - 10am

Creating Inclusive Workplaces: Neurodiversity and Accessibility

In the pursuit of fostering diverse and inclusive work environments, understanding and embracing Neurodiversity is essential. This webinar aims to shed light on the significance of Neurodiversity in the workplace and highlight the pivotal role of accessibility in ensuring an inclusive atmosphere for all individuals.

Mental health blog

Stress Awareness Month – Getting a good work-life balance to reduce stress in the workplace

April is Stress Awareness Month, and we encourage employers to focus their attention on how stress in the workplace can affect the productivity and mental health of employees, and what advise can be given to help employees maintain a good work-life balance. Stress is a term we are all familiar with and we’ve all likely […]